Fundraising sustainably allows nonprofits like yours to thrive. While you might bring in more contributions during certain seasons, such as your year-end giving campaign and annual events, it’s important to consider how you’ll fund your organization's activities year-round. Plus, having multiple revenue streams allows for more flexibility in your nonprofit’s budget.

To help your organization diversify its funding, this guide will outline the most common nonprofit revenue streams. We’ve broken them down into the following major categories:

- Individual Donations

- Corporate Philanthropy

- Earned Income

- Investments

- Grants

Keep in mind that your fundraising and financial management strategies should work together to fund your mission and help your nonprofit achieve its goals. Let’s get started by discussing the backbone of nonprofit revenue generation: individual donations.

Nonprofit Revenue Stream #1: Individual Donations

If your nonprofit is like most, contributions from individual donors make up the bulk of your funding. This becomes especially evident when you think about all of the different ways your supporters can give to your organization!

Here are some popular types of individual donations:

- One-time donations of all sizes, including small, mid-level, and major gifts.

- Recurring donations, which come in monthly or annually through your online donation page.

- Planned or legacy gifts such as bequests, trusts, and charitable gift annuities.

- Event revenue from ticket sales, peer-to-peer campaigns, purchases made at the event (such as auction items), and direct contributions.

- In-kind donations, which are gifts of goods or services rather than money.

Contributions from passive fundraising programs also fall into the category of individual donations—and these fundraisers are some of the most sustainable revenue streams out there! Two of the most common types are online shopping fundraisers and gift card sales, and the best way for your nonprofit to launch both of these programs is by partnering with a dedicated fundraising platform like ShopRaise.

How to Start Generating Revenue With ShopRaise

ShopRaise allows shoppers to support their favorite causes as they make everyday purchases from many popular businesses. All they have to do is download the ShopRaise app and browser extension, which will automatically contribute a portion of their sales totals at participating online retailers to a nonprofit of their choice.

To participate in gift card fundraising, shoppers just need to navigate to the Gift Card Store in the ShopRaise app and buy a digital gift card of their choice. Once they receive the card via email, they can forward it to a friend or family member as a gift, which the recipient can use for online or in-person purchases. Or, the supporter can use the gift card themselves to make purchases through ShopRaise’s online shopping fundraiser, thereby contributing even more to your organization!

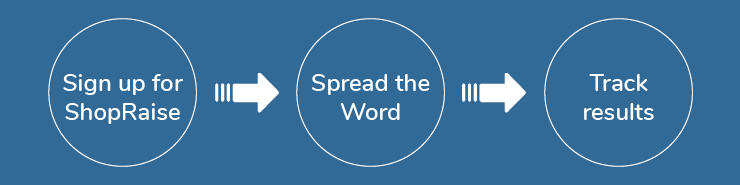

On the organizational side, your nonprofit can get started with ShopRaise in three easy steps:

1.Sign up for ShopRaise. ShopRaise’s experts will walk you through the onboarding process, handle negotiations with retailers, and even create a branded landing page for your nonprofit.

2. Spread the word. Leverage your nonprofit’s website, email marketing, flyers, and social media to give supporters instructions for getting started and regularly remind them to shop for your cause. ShopRaise can also help with this step by designing branded templates for various communications.

3. Track results. You can view real-time fundraising data as supporters make purchases, so you can thank your top supporters and adjust your marketing strategy in real time. ShopRaise protects shoppers’ privacy by limiting the details your nonprofit sees to just their names and the total amounts they’ve raised—only the shopper will know exactly what items they purchased.

ShopRaise is completely free to join, has a user-friendly interface, and scales with your organization. And it doesn’t just work for nonprofits—schools, associations, sports teams, community groups, and faith-based organizations can also incorporate this revenue stream into their strategies!

Nonprofit Revenue Stream #2: Corporate Philanthropy

The term “corporate philanthropy” refers to charitable contributions made by for-profit companies to nonprofits. Businesses of all sizes are willing to partner with nonprofits in their communities as part of their corporate social responsibility (CSR) initiatives. Let’s dive deeper into how you can leverage their generosity for sustainable nonprofit revenue generation.

Why Businesses Engage in Philanthropy

Corporate philanthropy is a win-win for nonprofits and businesses. While the benefits for nonprofits are clear—additional funding for their missions and stronger relationships within their communities—the advantages for businesses are a bit more complicated. To understand them more easily, let’s look at some of the top CSR statistics as reported by Double the Donation:

- 71% of employees think it’s important to work at a company that gives back to its community.

- 89% of corporate executives think their employees are more engaged and satisfied when their company has a strong sense of purpose (in which CSR plays a key role).

- 58% of companies say that corporate giving programs are important for retaining employees.

- 77% of consumers want to purchase goods and services from companies with CSR initiatives.

- 73% of investors try to invest in companies that are working to improve the environment and society.

In summary, CSR allows businesses to make the world a better place while improving their reputations with their employees, customers, and stakeholders, leading to improved performance.

Types of Corporate Philanthropy

There are many different forms of corporate philanthropy that your nonprofit could tap into, but businesses are most likely to offer the following programs:

- Event sponsorships. Some businesses prefer to sponsor nonprofit fundraising events through monetary contributions, while other sponsorships involve in-kind donations such as free catering services or auction items. Either way, the most effective partnerships are mutually beneficial. In return for your sponsors’ contributions, you’ll typically provide them with free publicity in your event marketing materials.

- Matching gifts. When an employee of a company with a

matching gift program donates to your nonprofit and submits a match request, their employer will also contribute, usually matching the original gift at a 1:1 ratio. Make it easy for donors to take advantage of this opportunity by embedding a matching gift tool directly into your online donation page. The best tools have auto-submission capabilities, meaning that all the donor has to do to submit a match request is enter their work email address! - Volunteer grants. Similar to matching gifts, employees of companies with volunteer grant programs can submit the number of hours they volunteered with your nonprofit. Then, the business will make a financial donation based on those hours. Make sure to communicate with your volunteers about checking their eligibility for these opportunities and help them track their hours correctly.

The corporate philanthropy world is expansive, and there are plenty of unique opportunities that businesses offer to fund nonprofits’ missions. Brainstorm with your team to find the right combination of corporate giving programs that will constitute a reliable revenue stream for your organization.

Nonprofit Revenue Stream #3: Earned Income

Earned income is usually associated with for-profit organizations rather than nonprofits. However, it’s legal for your nonprofit to generate revenue as long as it’s reinvested into your organization.

Some of the best ways to incorporate earned income into your nonprofit’s funding model include:

Selling Products and Services

Nonprofits that sell courses, books, training opportunities, and other products and services can keep themselves funded through sales. For example, the Nonprofit Leadership Alliance (NLA) is a nonprofit organization that sells skills development courses and training programs to nonprofit professionals, helping them improve their fundraising, management, and leadership abilities.

Of course, to generate revenue from your product and service offerings, you need to market them. One marketing strategy that works particularly well for generating sales leads is search engine optimization (SEO).

Online shopping is incredibly popular. Let’s say you need to hire a cleaning service or want to bulk-order greeting cards. If you have no particular business or brand in mind, you’d likely turn to Google or another search engine. This means that customers who are ready to buy often use search engines.

Your nonprofit can get in touch with its target customers through SEO by:

- Identifying keywords. What keywords are your potential customers likely searching when they’re ready to make a purchase or learn more about your offerings? This might be the type of product or service you’re selling and more generic searches related to it. For example, the NLA might target both the keywords “fundraising courses” and “tips for nonprofit professionals.”

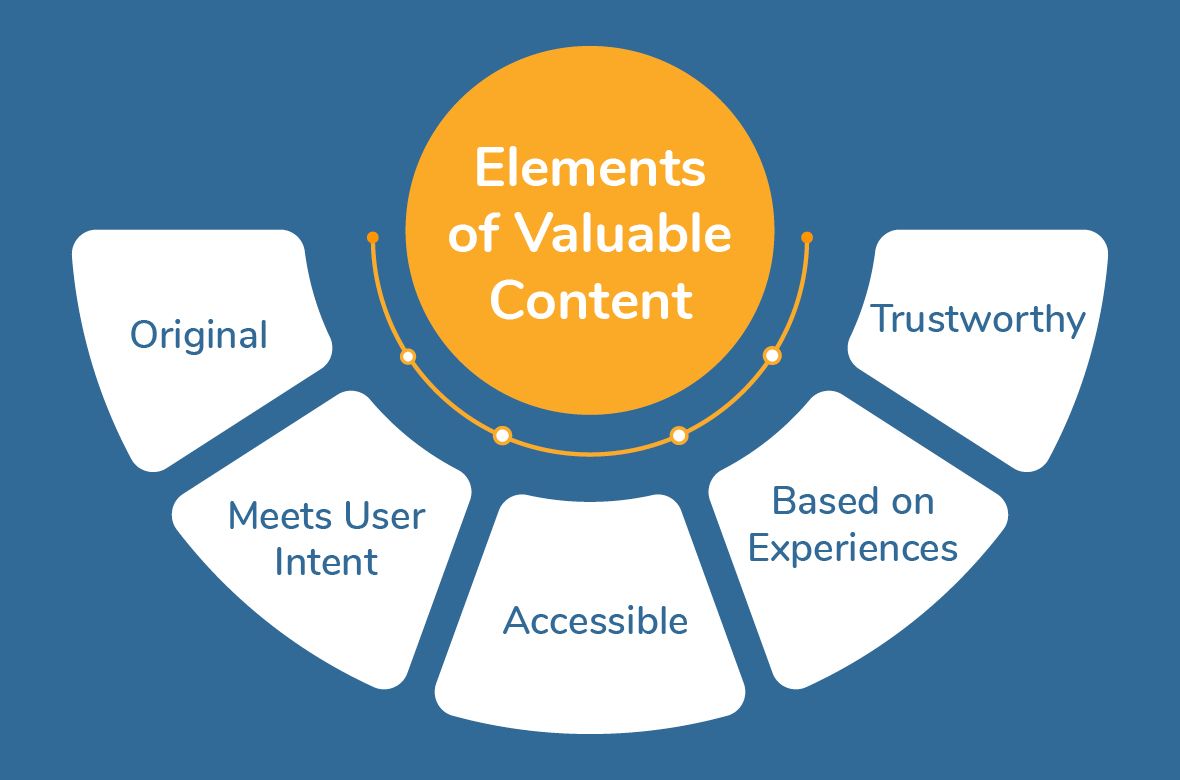

- Creating valuable content. For each keyword you want to target, create a piece of helpful content focused on it. This content should be original, show off your nonprofit’s expertise, and feature a call to action to invite customers to move down the sales funnel.

- Improving your website’s technical performance. Search engines want to create a positive user experience and subsequently reward websites that function well with better search rankings. Improve your website by decreasing loading times, creating a user-friendly interface, and making your site mobile-responsive.

Keep in mind that SEO is a long-term strategy. It takes a while to get going, but once set up and maintained, it can bring in high-value sales leads as long as your content ranks well. If you need help getting started with SEO or improving your current strategy, consider working with an SEO marketing agency.

Creating a Membership Program

Nonprofits like museums, art organizations, and zoos all have membership programs. These types of organizations have obvious perks for supporters, but in reality, any nonprofit can create a successful membership program with a little creativity.

Some membership perks you might offer include:

- Discount codes for products, services, and merchandise

- Reduced cost and early access to event tickets

- Access to exclusive content like blog posts, videos, and webinars

- Opportunities to connect with other members, like access to a members-only communication platform or events

- Free perks, like an annual calendar, merchandise, and other gifts

You can automatically enroll any donor who gives above a certain amount in your membership program or make it separate from normal donations by requiring a regular fee. You might even consider creating membership tiers based on the amounts donors and members give.

Opening an online merchandise store

Boost your brand recognition and earn revenue at the same time with a merchandise store. Common examples of nonprofit merchandise include:

- Apparel like t-shirts, hats, and sweaters

- Beverage containers like mugs and thermoses

- Small items like magnets and stickers

Ultimately, the limits of what can be merchandised depend on your own creativity. For example, the World Wildlife Fund takes inspiration from the animals they work to save by selling plushies that donors can buy directly or receive as part of their donations.

Selling Fundraising eCards

In addition to merchandise, you can earn revenue by selling eCards. eCards are electronic greeting cards that supporters can buy to celebrate important occasions with their loved ones and spread awareness of your mission.

In an eCard fundraiser, eCards are usually priced higher than normal greeting cards in acknowledgment that they’re mostly being bought to help a good cause. That said, some nonprofits add a twist to their eCard fundraisers to provide supporters with extra value.

For example, check out this Valentine’s Day fundraising eCards designed by One Tail at a Time:

As part of this fundraiser, eCard buyers could purchase a more expensive package that included a visit from puppies! This means supporters could not only send their loved ones a cute eCard but also some fun with a pile of real-life puppies.

Nonprofit Revenue Stream #4: Investments

Investing also isn’t commonly associated with nonprofit revenue generation. However, you’ve likely heard of endowment funds, which are based on investment. If a major gift comes in the form of an endowment, your nonprofit doesn’t spend the initial donation but instead deposits it into an investment account. Then, you’ll put the interest earned on the endowment toward a particular initiative, as designated by the donor.

Nonprofits can also leverage many of the same investing methods as individuals, including:

- Brokerage accounts

- Stocks

- Bonds

- Treasury bills

- Certificates of deposit (CDs)

- Cryptocurrency

While investments aren’t particularly lucrative in the short term, they help your organization build assets and grow its long-term savings. That way, if one of your other funding sources falls through, you’ll have reserve funds to help keep your nonprofit afloat while you reassess your funding model and find replacement revenue streams.

Nonprofit Revenue Stream #5: Grants

Many organizations provide grant funding to nonprofits, including government entities, corporations, and public, private, and family foundations. Most of these grants are competitive, but they can provide critical funding for some of your organization’s most important initiatives.

If your nonprofit decides to apply for grants, here are a few tips to increase your chances of securing funding:

- Pursue opportunities that align with your organization’s needs. Grant funding is often restricted, meaning it has to be used for a specific project or program at your nonprofit. Read the grant requirements carefully to make sure you could use the funding for an initiative your nonprofit is planning.

- Build relationships with funders. Many grant applications are invitation-only, and even opportunities that aren’t will be more within reach if you connect with the funder in advance. Share resources about your mission and invite them to an event if possible so they can see your nonprofit’s impact firsthand.

- Write strong grant proposals. In addition to writing clearly and concisely, double-check that you’ve followed the grantmaker’s guidelines exactly. These include adhering to the deadline, ensuring the sections are the correct length and in the right order, and attaching any requested documents such as a proposed budget or past financial records.

- Consider in-kind grants like the Google Ad Grant. Rather than providing direct funding, the Google Ad Grant helps your nonprofit offset its marketing expenses by providing $10,000 per month in free search ads. The best part about this grant is that it isn’t competitive—any nonprofit can receive an advertising stipend as long as it meets the eligibility criteria and submits an application through Google for Nonprofits.

Funders tend to think of grants as investments in a good cause. As you seek out and apply for grants, show them that awarding funding to your organization would be a good investment by highlighting your past successes and demonstrating how your mission aligns with their values.

Wrapping Up: Additional Resources on Nonprofit Revenue Generation

As you consider which revenue streams to include in your nonprofit’s funding model, remember that all of the funds you bring in have to be reinvested into your nonprofit. If your organization has money left over after your expenses are covered, use it to bolster your reserve funds. This way, you’ll be more prepared for future challenges and have more flexibility in planning for growth.

For more information on nonprofit revenue generation, check out these resources:

- 20+ Holiday Fundraising Ideas for a Merry and Bright Season. Explore a wide variety of campaigns, events, and other funding sources that are well suited to the holiday season.

- Alternatives to AmazonSmile: FAQ + Next Steps for Nonprofits. Discover what happened when a popular nonprofit revenue stream was discontinued and how nonprofits can still leverage other similar platforms for ongoing fundraising.

- Shop for a Cause: How to Give Back While Shopping Online. Learn more about the benefits of online shopping fundraisers and different ways to run them.